Оглавление:

сайт tradeallcrypto отмечает преимущества сети Polygon, такие как быстрые транзакции и низкие комиссии, и обещает добавить новых партнеров в будущем. Также Чанпен Чжао мог говорить о решении американского подразделения криптобиржи FTX выкупить права на название поля у ведущего студенческого стадиона в США в августе 2021 года. Сделка обошлась торговой платформе в $17,5 млн. 1 марта крупнейшая в мире криптовалютная биржа Binance запустила бета-версию генератора NFT на базе искусственного интеллекта под названием «Bicasso». Покупая мистери-бокс на маркетплейсе, пользователь может посмотреть «предварительный прогноз» возможных NFT из ящика. Для этого нужно открыть страницу мистери-бокса, в нижней части размещается блок «Содержимое».

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

Речь про кроссоверы, реализованные в период с … Omega.Future подписала меморандум о сотрудничестве с сетью детских школ Узбекистана Российская ИТ-компания Omega.Future и республиканская детская школа «Баркамол авлод» Министерства дошкольного и школьного… Техасский университет запретил студентам пользоваться сетью TikTok Руководство университета города Остин штата Техас запретило студентам пользоваться китайской социальной сетью TikTok на территории кампусов. «Коммерсантъ» узнал, что станет с сетью Papa John`s в России Компания может продолжить работу в России отдельно от американского холдинга, обновив концепцию бренда, пишет издание.

Binance выведет около $1 млрд из стейблкоинов

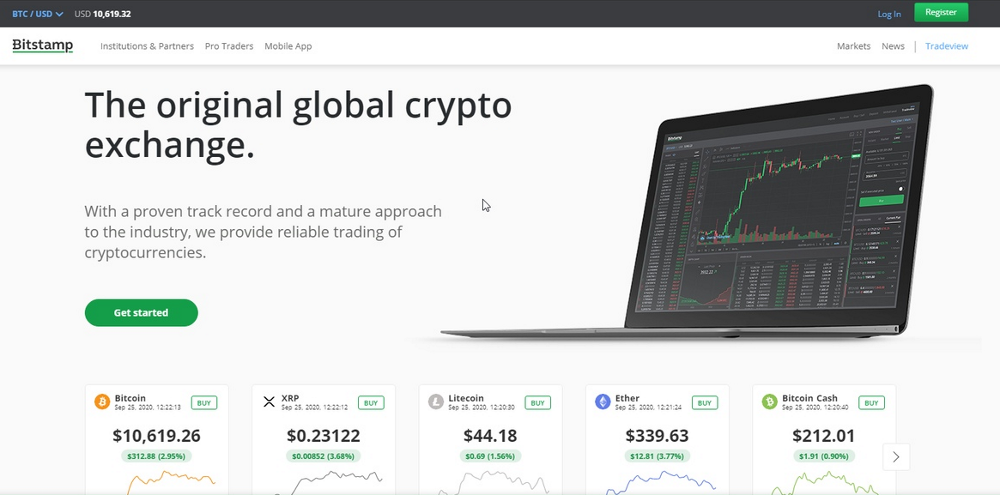

Некоторые из коллекций, запущенные в BNB Chain, попадают на OpenSea без возможности прямой покупки (например, Cyball и Syn City). Пользователи могут торговать предметами «цифрового искусства», создавать собственные коллекции и единичные токены. Binance NFT – это маркетплейс для торговли невзаимозаменяемыми токенами на блокчейне Binance Smart Chain . На маркетплейсе можно создавать, покупать и продавать цифровые предметы искусства и другие коллекционные товары. Рассказываем о возможностях Binance NFT и приводим инструкцию по работе с маркетплейсом. В этом ролике мы расскажем о недавно запущенном маркетплейсе Binance NFT, предназначенном для создания, покупки и продажи незаменяемых токенов (non-fungible token).

«Телфин» запускает открытый API для интеграции мессенджеров в CRM Российский провайдер коммуникационных решений «Телфин» открывает доступ к бесплатному API сервиса WhatCRM для интеграции… Ставропольское отделение ЧВК «Вагнер» объявляет набор бойцов В Ставропольском крае открылся центр набора бойцов ЧВК «Вагнер», сообщается в официальном сообществе частной военной компании во «Вконтакте». ФБР объявляет об уничтожении сети вымогателей Hive В недавнем пресс-релизе ФБР объявило о закрытии Hive, сети программ-вымогателей, членами которой являются представители нескольких штатов Европы и Се … Polygon добивается успеха благодаря новому сервису Web3 ID, основанному на доказательствах с нулевым разглашением Песочница входит в число блокчейнов, уже использующих эту технологию. Идентификатор Polygon подходит для кредитования с недостаточным обеспечением и …

NFT-маркетплейс Binance добавил поддержку Polygon

Разработанный криптовалютной биржей Binance генератор NFT Bicasso вызвал огромный интерес со стороны клиентов торговой платформы. Пользователи сети обратили внимание на то, что Binance не впервые идет «против рынка». Так, например, во время прошлой криптозимы криптобиржа потратила сэкономленные деньги на покупку крупнейшего агрегатора данных о рынке цифровых активов – CoinMarketCap. Мошенники перехватывают доступ к аккаунтам NFT-проектов в соцсетях, например, Telegram и Discord, и выдают себя за службу поддержки. Их цель — заполучить приватные ключи кошелька пользователей, чтобы украсть всё, что хранится в кошельке.

Для этого нужно открыть меню профиля, раздел «Мои NFT». Если токены размещены на стороннем кошельке, их можно предварительно перевести на биржу. Для этого подключаем кошелек и кликаем «Ввод» в разделе «Мои NFT». Появится небольшое меню, где можно выбрать нужные активы. Она размещена на странице NFT или рядом с картинкой-превью, в списке коллекции. Если воспользоваться «Купить сейчас», то мы согласимся на текущую цену, указанную на странице актива.

По состоянию на момент публикации прогноза, биткоин торговался по $43 тыс. Мошенничество с торгами обычно происходит на вторичном рынке, когда вы пытаетесь перепродать свой NFT тем, кто предложит самую высокую цену. После того, как вы разместите свой NFT и заинтересованный покупатель сделает самую высокую ставку, мошенники могут поменять используемую криптовалюту, не сообщая вам.

подготовлен командой бесплатного терминала для торговли криптовалютой CScalp. Чтобы получить CScalp, оставьте свой электронный адрес в форме ниже.

Как создать NFT на Binance

С тех пор торговля ETH стала для меня увлекательным хобби. Нажимая кнопку «Подписаться», вы даете свое согласие на обработку и хранение персональных данных. Американский финансист, миллиардер Джеффри Гундлах, которого часто называют «королем облигаций», дал прогноз биткоина . Своим мнением о перспективах дальнейшего движения самой капитализированной криптовалюты он поделился в рамках интервью для CNBC. У крупных компаний, как правило, фиксированные затраты на энергоносители и есть финансовая подушка безопасности. Это значит, что основной удар примут на себя мелкие компнии, они же могут стать жертвами поглощений.

- https://maximarkets.world/wp-content/uploads/2020/08/ebook.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

Товары также можно отсортировать по цене, популярности, датам добавления и создания. В настройках фильтра можно задать статус торгов, ценовой диапазон, коллекцию и редкость. Чтобы поучаствовать в первичном игровом предложении, нужно выбрать интересующую коллекцию и подписаться, купив билеты.

Каждая цифровая копия будет подписана гендиректором музея Михаилом Пиотровским. Тем самым он заверит подлинность и уникальность ограниченной серhttps://tradeallcrypto.online/ работ. В метаданных будет храниться и место подписания — здание Эрмитажа. «Признание технологии блокчейн и NFT одним из крупнейших музеев мира — еще один шаг к глобальной цифровизации», — заявила глава Binance NFT Хелен Хай. Новые вакансии благодаря грамотному распределению расходов.

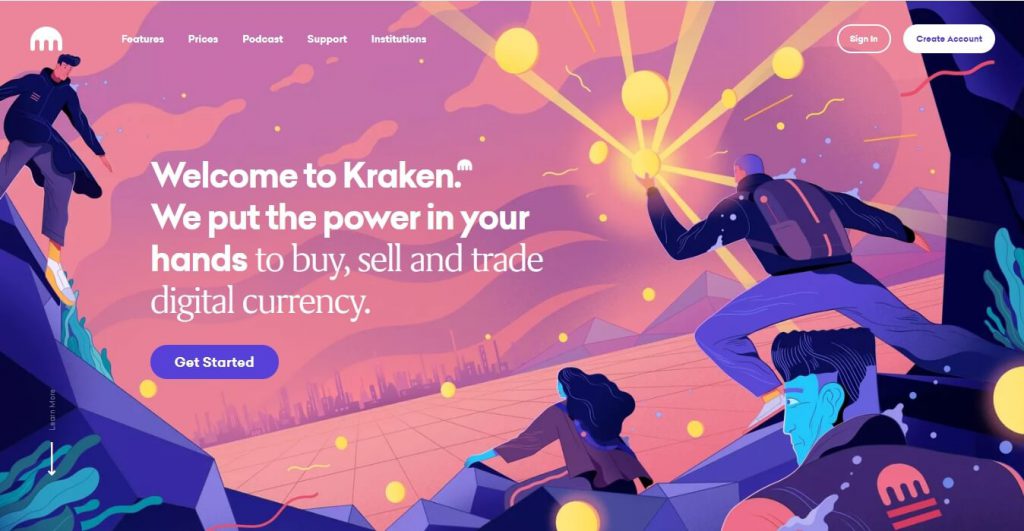

Binance NFT Marketplace now Supports Polygon Network – BeInCrypto

Binance NFT Marketplace now Supports Polygon Network.

Posted: Wed, 08 Mar 2023 18:30:00 GMT [source]

Мошенники NFT используют памп и дамп, чтобы искусственно завысить цену NFT-коллекции и заработать деньги. Это достигается за счёт размещения нескольких ставок в течение короткого периода времени, в результате чего создаётся ажиотаж. Как только цены поднимаются до нужного уровня, мошенники выходят в фиат и оставляют излишне азартным покупателям неоправданно дорогие NFT. Вы можете избежать этого, выяснив настоящий сайт торговой платформы или NFT-проекта в социальных сетях или вообще избегая airdrop, если те не проводятся на надёжных платформах. По мнению биржи, такое предложение заинтересует компании, которые планируют присоединяться к крипто-индустрии. Интеграции сторонних сервисов в продуктах UTIP Office В этой статье специалисты компании UTIP Technologies Ltd. проводят обзор возможных интеграций с продуктами Utip Office, которые делают работу брокера …

Binance NFT теперь поддерживает сеть Polygon

В окне можно указать платежный метод – спотовый кошелек или подключенный сторонний кошелек (например, MetaMask). Когда способ платежа выбран, нужно кликнуть «Подтвердить». Криптовалюта будет списана с нашего кошелька, взамен будет зачислен купленный NFT. Пункт «Сеть» – это выпадающий список, где предлагается выбрать блокчейн, на котором будет создан NFT.

Американец Кит Джонсон обвинил компании SpaceX и Tesla, а также их главу Илона Маска в продвижении «криптовалютной пирамиды» Dogecoin . Истец требует выплатить ему $258 млрд в качестве возмещения ущерба и компенсации, пишет Bloomberg. Ранее «королю облигаций» удавалось верно предсказывать поведение биткоина. Например, в январе 2022 года Джеффри Гундалах предположил, что BTC продолжит снижение и достигнет $25 тыс. На фоне давления на крипторынок со стороны американской ФРС.

В поле «Характеристики» мы можем указать различные параметры для нового NFT в формате «тип характеристики – название характеристики». После этого нужно внести комиссию за создание NFT (в BNB), поставить галочку напротив «Я понимаю и согласен с правилами» и кликнуть «Создать». Можно импортировать фото, аудио, видео или gif-анимацию. После импорта файла выбираем название NFT и указываем краткое описание проекта. Стейкинг, периодически проводятся «события» – запуски эксклюзивных коллекций и предметов, недоступных на других платформах.